Onebeat Raises Additional $15M to Rewrite the Rules of Retail—Led by Schooner Capital

With a proven track record with over 220 global retailers, Onebeat is bringing its AI-driven, dynamic inventory optimization platform to retailers across the U.S.

[New York – May 6, 2025] —Onebeat, the dynamic inventory optimization and execution platform, today announced its official U.S. market launch backed by $15 million in funding led by Schooner Capital with participation from Magenta Venture Partners, Surround Ventures, AnD Ventures, J-Ventures, Wilson’s Bird Capital, Podemsky Ventures and INcapital Ventures. This brings the company’s total funding to date to $30 million. With fresh capital, a rapidly expanding global footprint and a proven track record across LATAM, EMEA, and APAC—supporting major brands like Calvin Klein, Panasonic, and Aramis—this milestone underscores Onebeat’s momentum in redefining how retailers execute real-time inventory decisions.

Consumer expectations for variety, freshness, and instant gratification have created unprecedented challenges for today’s omnichannel retailers—skyrocketing inventory levels, tied-up capital, and shrinking margins. It is estimated that 15-30% of manufactured clothing is never sold, going straight to waste. Traditional forecast-based inventory management systems have locked retailers into rigid, inefficient execution schemes, resulting in stock imbalances, missed sales, and excessive overhead.

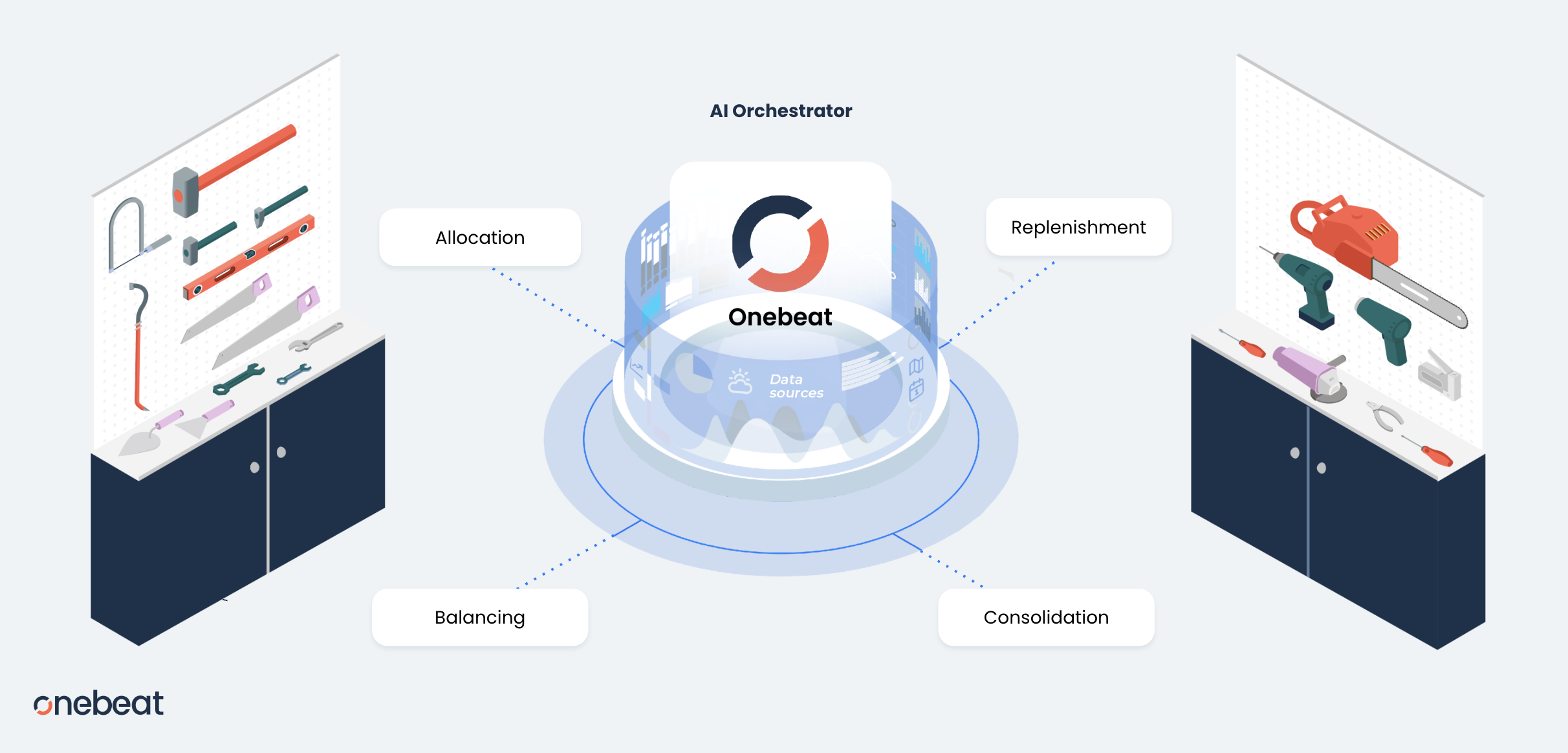

Founded in 2018 and built on the principles of the Theory of Constraints, Onebeat was developed by global supply chain experts from the Goldratt Group to bring agility and precision to retail inventory management. The platform transforms replenishment, allocation, and liquidation into dynamic, daily SKU-store level decisions. As a result, retailers benefit from improved product availability, reduced waste, and measurable financial results within 120 days. Unlike static, forecast-based systems, Onebeat continuously aligns inventory with real demand, delivering significant impact: a 15% increase in sell-through, 71% reduction in stockouts, 33% decrease in inventory levels, 60% faster inventory turns, and a 3–5% uplift in margins.

“Retailers today don’t need more data—they need intelligent AI-driven execution,” said Dr. Yishai Ashlag, CEO and Co-founder of Onebeat. “That’s why we built Onebeat as a new kind of AI-powered retail operating system—one that translates data into real-time, revenue-driving execution. This investment from Schooner Capital is more than capital—it’s a powerful vote of confidence in our global impact and our vision. With their support, we’re ready to scale our momentum and bring agile, intelligent retail to the U.S. market.”

“Onebeat has demonstrated exceptional leadership, cutting-edge technology, and impressive momentum,” said Orhan Gazelle, Managing Director at Schooner Capital. “We’re excited to support their expansion and be part of their journey as they expand into the U.S. market and revolutionize retail operations on a global scale.”

“Onebeat gave us a common language across production, logistics, and sales—so we could chase one goal: never run out of stock,” said Kenichi Koyama and Daisuke Ihara, Group Manager, Panasonic Japan. “Inventory became visible, actions clear, and excess slashed. Now, we’re faster, leaner, and ready for whatever demand throws at us.”

Already trusted by more than 220 retailers worldwide, Onebeat empowers retail organizations to act quickly, adapt in real-time, and maximize profitability through precise inventory flow. This U.S. launch positions the company to serve a growing base of omnichannel, specialty, and department store retailers navigating rising consumer expectations, supply chain disruptions, and tightening margins.

About Onebeat

Onebeat is a dynamic inventory optimization and execution platform that helps retailers maximize revenue, reduce waste, and improve margins by aligning inventory with demand—daily, by SKU and store. Built on the Theory of Constraints and powered by pre-trained, proven AI, Onebeat delivers clear, actionable insights that drive agility and growth across the product lifecycle. Learn more at https://onebeat.co/.

About Schooner Capital

Founded in 1971, Schooner Capital is a Boston-based private growth stage investment firm with a long-term perspective. The firm focuses primarily on technology, software, and services companies at all stages of development, while also investing in other sectors. Learn more at https://www.schoonercapital.com/.

Onebeat